Growth Strategy

Basic Management Policy

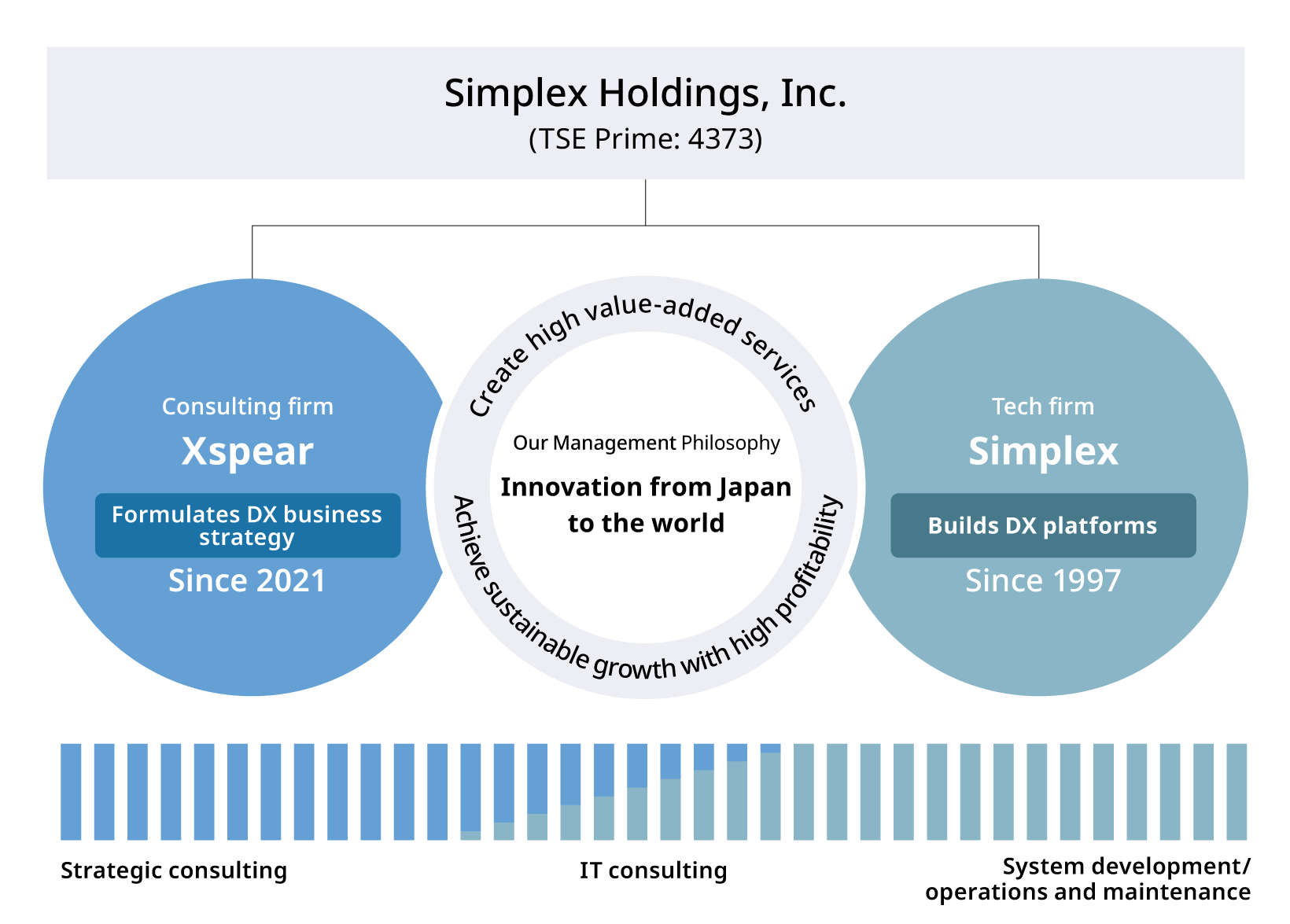

With the goal of bringing “Innovation from Japan to the world,” all of us are united in our pursuit of “Creating high value-added services” that contribute to the business success of our clients. Our basic management policy is to contribute to clients as a technology partner with a solid understanding of their business and to constantly strive for achieving sustainable growth with high profitability.

Currently, Simplex Holdings, a listed company, comprises Simplex, a tech firm founded in 1997 and Xspear, a consulting firm established in 2021. The two core companies work to provide DX support to clients. Simplex and Xspear execute their business strategies as operating companies, while Simplex Holdings concentrates and strengthens its functions as a holding company to further enhance corporate value by formulating and promoting strategies and implementing appropriate governance and monitoring.

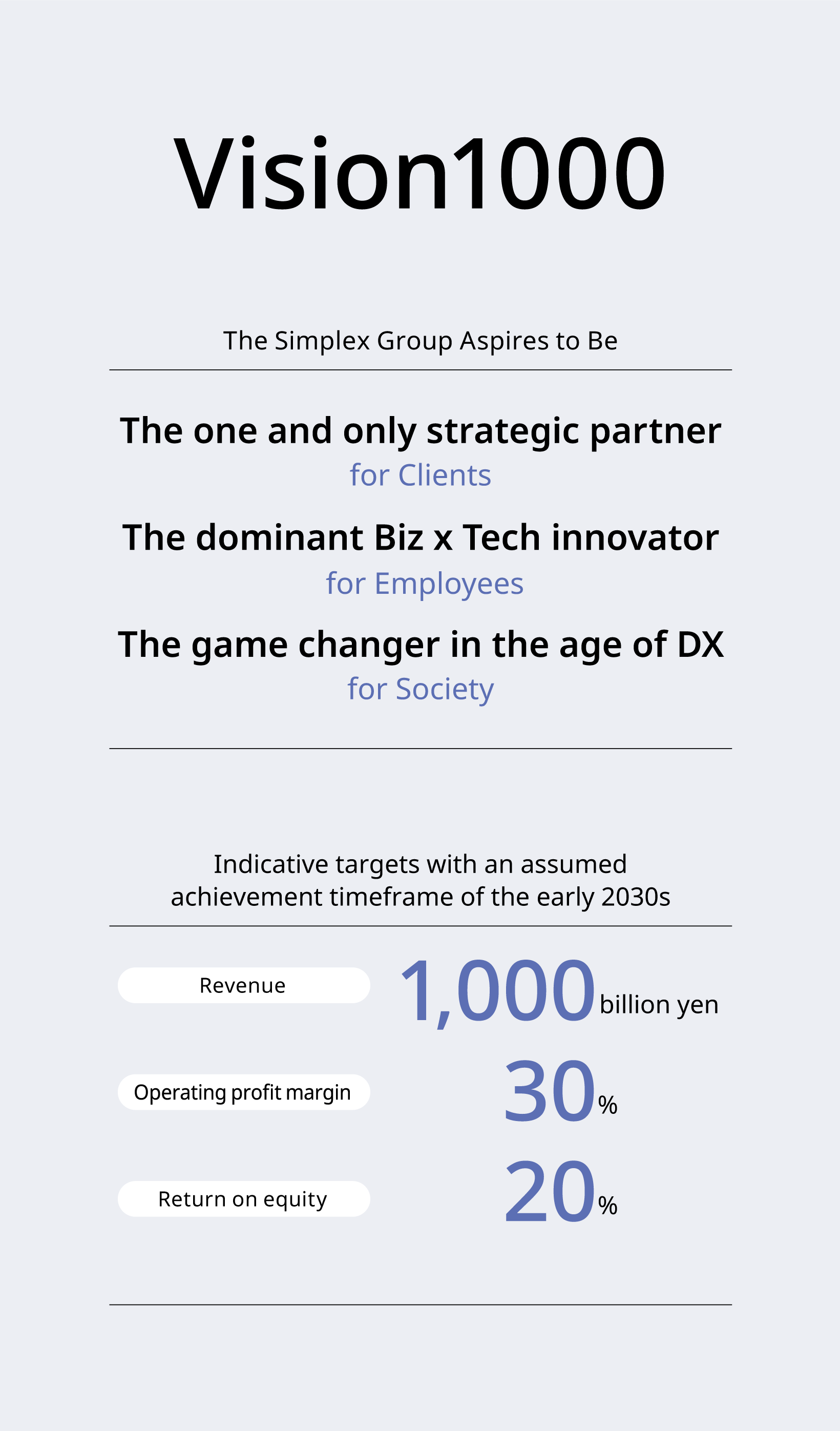

Vision 1000

In order for the Simplex Group to have a certain social impact amid the growing momentum of DX, we believe it is important to aim first of all for achieving an annual revenue of 100 billion yen. Based on this belief, in October 2023, we have formulated Vision1000, which specifies what the Group aims to be, as our long-term growth strategy to appropriately adapt to expected future changes in the business environment and client needs, whereby we seek to improve our corporate value in a sustainable manner.

Simplex Group’s vision

There are three goals that we aim to achieve with Vision1000. The first is to be the one and only strategic partner for our clients. SBI SECURITIES, the leading comprehensive online securities company in Japan in terms of number of accounts and market share, has selected us to be its one and only strategic partner. We aim to be similarly chosen by leading firms in various industries.

Second, for our employees, the Simplex Group will continue to be the dominant Biz x Tech innovator. Innovation in the DX field is at the forefront of the times, and the exciting appeal of this challenge is attracting many talented people. In order to continue to draw in such talent, Simplex Group will continue to aspire to be a dominant innovator in the field of Biz × Tech.

The third is to be the game changer in the age of DX for society. While more and more Japanese companies are facing challenges in DX, we are of the view that in-house production is not the only answer, and we aim to be the game changer who can have an impact on society.

Illustrative projection

Vision1000 sets out indicative targets of 100 billion yen in revenue, a 30% operating profit margin, and a 20% ROE by the early 2030s. If we can reach this level, we should finally be able to draw close to the top tier players in the IT industry in terms of operating profit.

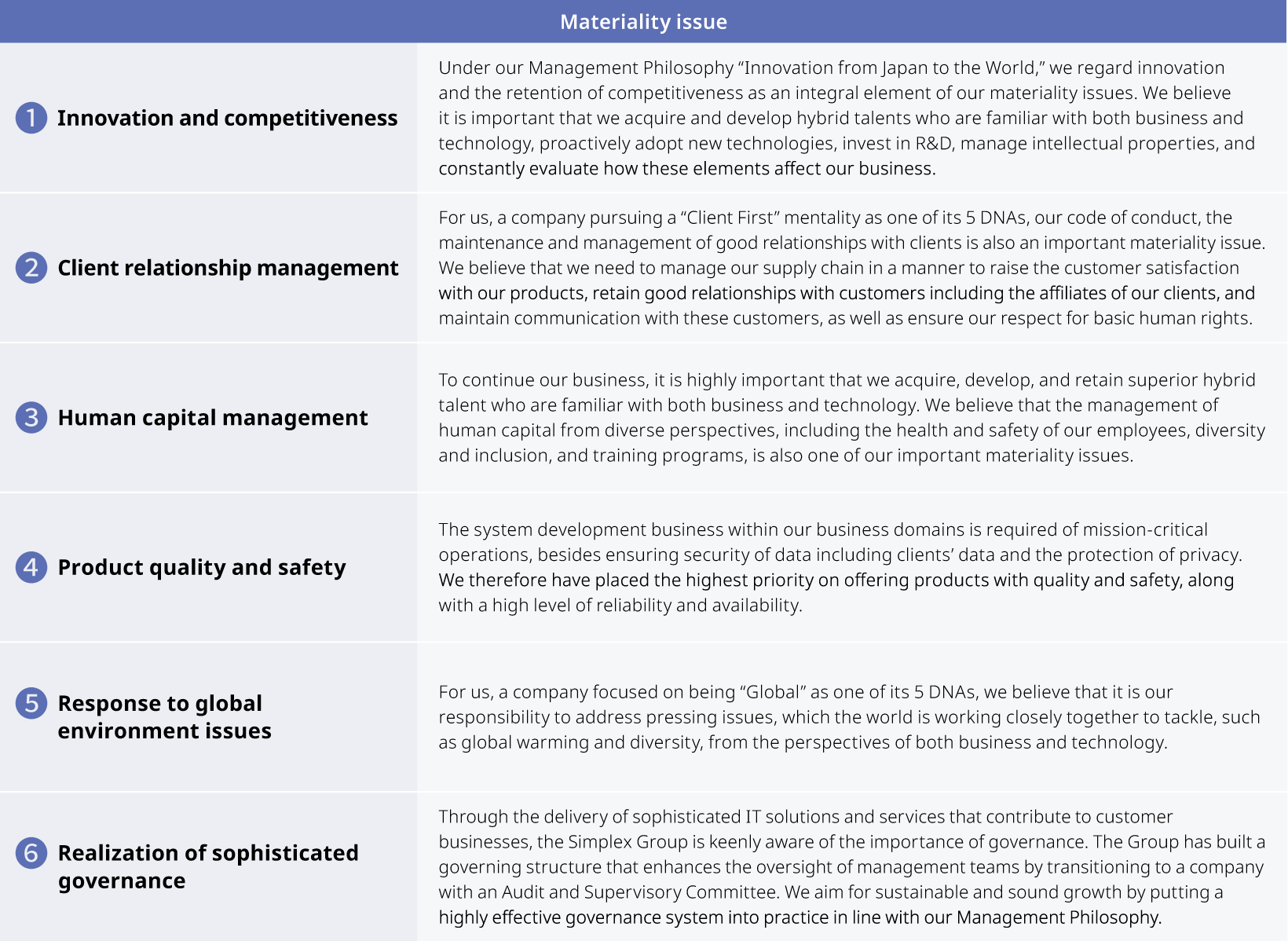

Materiality

We have identified six materiality issues primarily in light of our management philosophy, code of conduct, values and long-term growth strategy. Based on these materiality issues, we develop, implement, and promote strategies, as well as review and revise the materiality issues, as needed, in line with changes in the business environment and society.

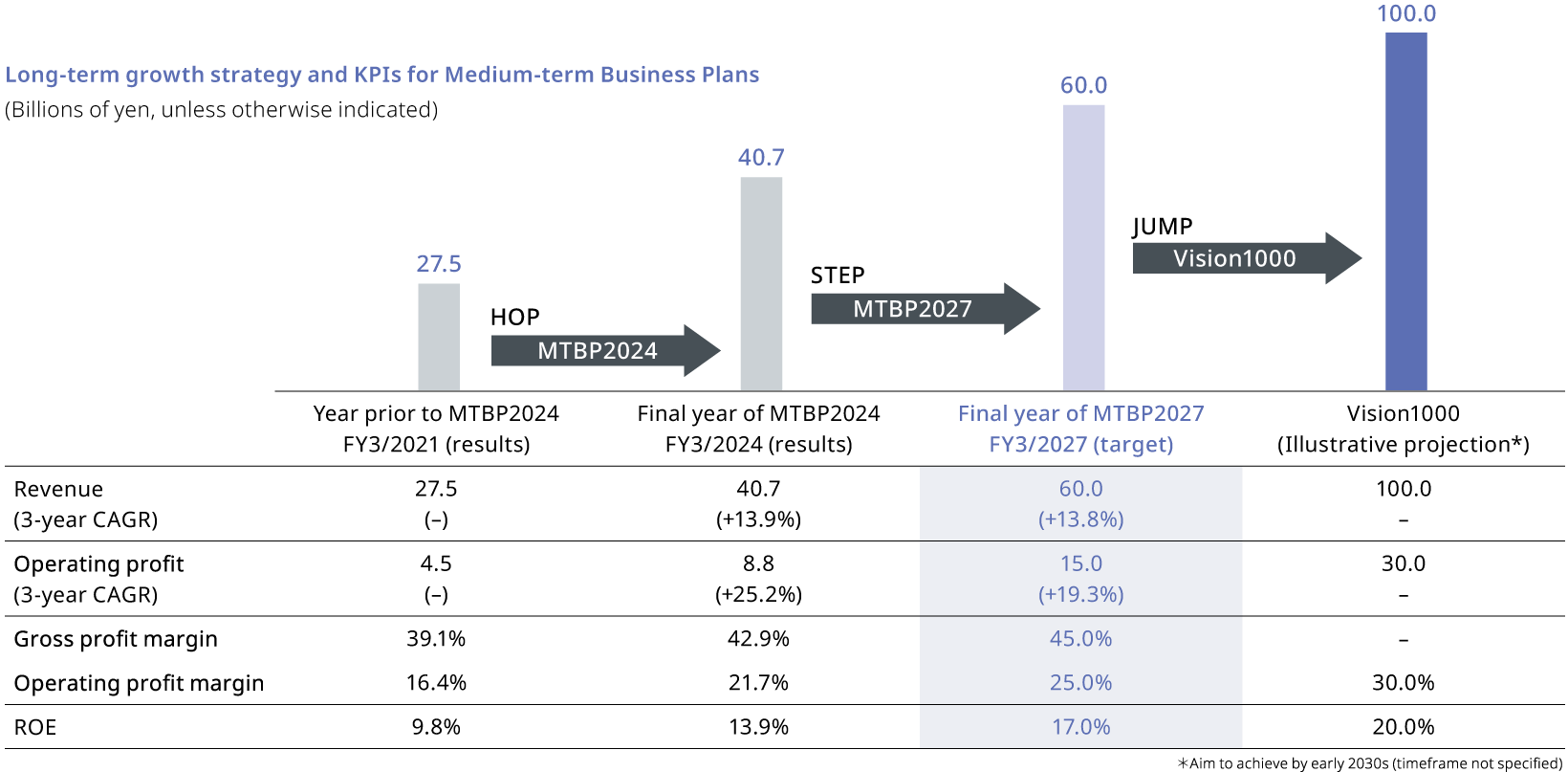

MTBP2027

In October 2023, We announced its Medium-Term Business Plan covering the three-year period beginning in FY3/2025 (MTBP2027). This also represents the midpoint of Vision1000, our long-term growth strategy, MTBP2027 has our short-, medium-, and long-term implementation strategies. It expresses our commitment to achieving numerical targets for FY3/2027, the fi nal year of MTBP2027.

Themes

In MTBP2027, we continue to build on the fundamental strategies of MTBP2024 and promote “domain expansion” and “deep-diving into domains” by further leveraging intra-Group synergies between Simplex and Xspear. In the context of domain expansion, Xspear, positioned as the spearhead in exploring new domains, makes approaches to clients’ management through leveraging strategic consulting as a hook. By enhancing the Simplex Group’s reputation, we aim to increase the number of clients who recognize us as a strategic partner. Next, in the context of deep-diving into domains, we explore building relationships similar to that which we have with SBI Holdings and SBI SECURITIES. Specifically, we aim to go beyond mere outsourcing client-vendor relationships to combine resources and expertise of both parties for system development projects and establish structures for these. In doing so, we are committed to exceeding client expectations with outstanding results.

Numerical targets

Regarding numerical targets for the MTBP, we have set the figures for FY3/2027, the final year of the plan, as follows (changes versus the figures for FY3/2024, the previous fiscal year are shown in parenthesis). For FY3/2027, we plan to achieve revenue of 60 billion yen (an increase from 40.7 billion with a three-year CAGR of 13.8%) and operating profit of 15 billion (an increase from 8.8 billion yen with a three-year CAGR of 19.3%). In terms of profitability, the gross profit margin is expected to increase by 2.1 percentage points to 45.0%, due to a mixture of an increase in the proportion of revenue from Strategy/DX Consulting and improved productivity.

The operating profit margin is expected to increase by 3.3 points to 25%, primarily due to an improved gross profit margin and a decline in the SG&A expenses ratio. We are also targeting an increase in ROE of 3.1 points to 17%. For FY3/2025, the first year of MTBP2027, we are targeting operating profit of 10.6 billion yen, up 19.8% year on year.

Basic policy on capital allocation

We invest in growth that will lead to strengthening our business foundation. Among others, we place the highest emphasis on investing in our human resources. Positioning human capital as the most important type of management resource for value creation, the Simplex Group is committed to recruiting and training the top 10% of talent in the market. In MTBP2027, we will continue to actively recruit new graduates and mid-career professionals, while striving to create a system and corporate culture that promotes diverse career choices and employee growth.

In addition, to realize Vision1000, it is also important to invest in new and growth domains. We have set a ratio of R&D expenses versus revenue at approximately 4% for each fiscal year. With a view to achieving further growth after MTBP2027, we intend to aggressively conduct R&D to expand our portfolio in growth domains.

Regarding M&A, we will aim to acquire or merge with companies that directly contribute toward strengthening the Simplex Group’s core competencies, such as boutique consulting firms (that offer sophisticated expertise and services despite their relatively small size) and tech firms that boast high profitability. In particular, we intend to be more aggressive in acquiring boutique consulting firms and have factored in approximately 3.5 billion yen in revenue from inorganic growth for FY3/2027. On the other hand, we will also make minor investments in areas that indirectly contribute to strengthening our core competencies.

In line with this strategy, whenever attractive investment opportunities arise, we will first allocate free cash flow to additional investments. Then, if funding is required, we prioritize debt financing. We aim for a net leverage ratio of approximately three times as a guideline for raising funds.

ROE targets and shareholder returns

Due to our MBO in 2013, our paid-in capital is larger than that of a typical company of its size. As we are committed to capital efficiency-conscious management, we recognize that shareholder returns, which contribute to improving capital efficiency, are also an important measure in capital allocation. Specifically, we will strive to enhance shareholder returns through dividends, considering business performance trends, ROE levels, growth investment opportunities, and other factors.

With regard to dividends, we have adopted a strategy of stable and sustainable increases in dividend per share through profit growth, and in March 2024, we changed our policy to raise the baseline dividend payout ratio from 30% to 40%. In addition, in line with our desire to have a shareholder return policy that contributes to improving capital efficiency, we intend to flexibly implement share buybacks, taking into account market conditions, including stock prices, on top of the aforementioned considerations regarding dividend decisions.