Environment

As a member of a society that operates in a global environment, we believe that addressing climate change and other environmental issues is vital.

We recognize the need to reduce the environmental impact of our business activities and are proactively working to address environmental issues and collaborate with other companies that aim to realize a sustainable society.

We voluntarily adhere to the TCFD*, which has established a framework for international disclosure of information on climate change. In addition to disclosure and monitoring based on climate change risk, we also support biodiversity conservation efforts and promote the conservation and rational use of the world’s limited water resources.

Click below button for more information on TCFD disclosures (climate change-related governance, risk management, strategies, indicators, and targets).

TCFD is the “Task Force on Climate-Related Financial Disclosures,” established by the Financial Stability Board (FSB).

Energy Management

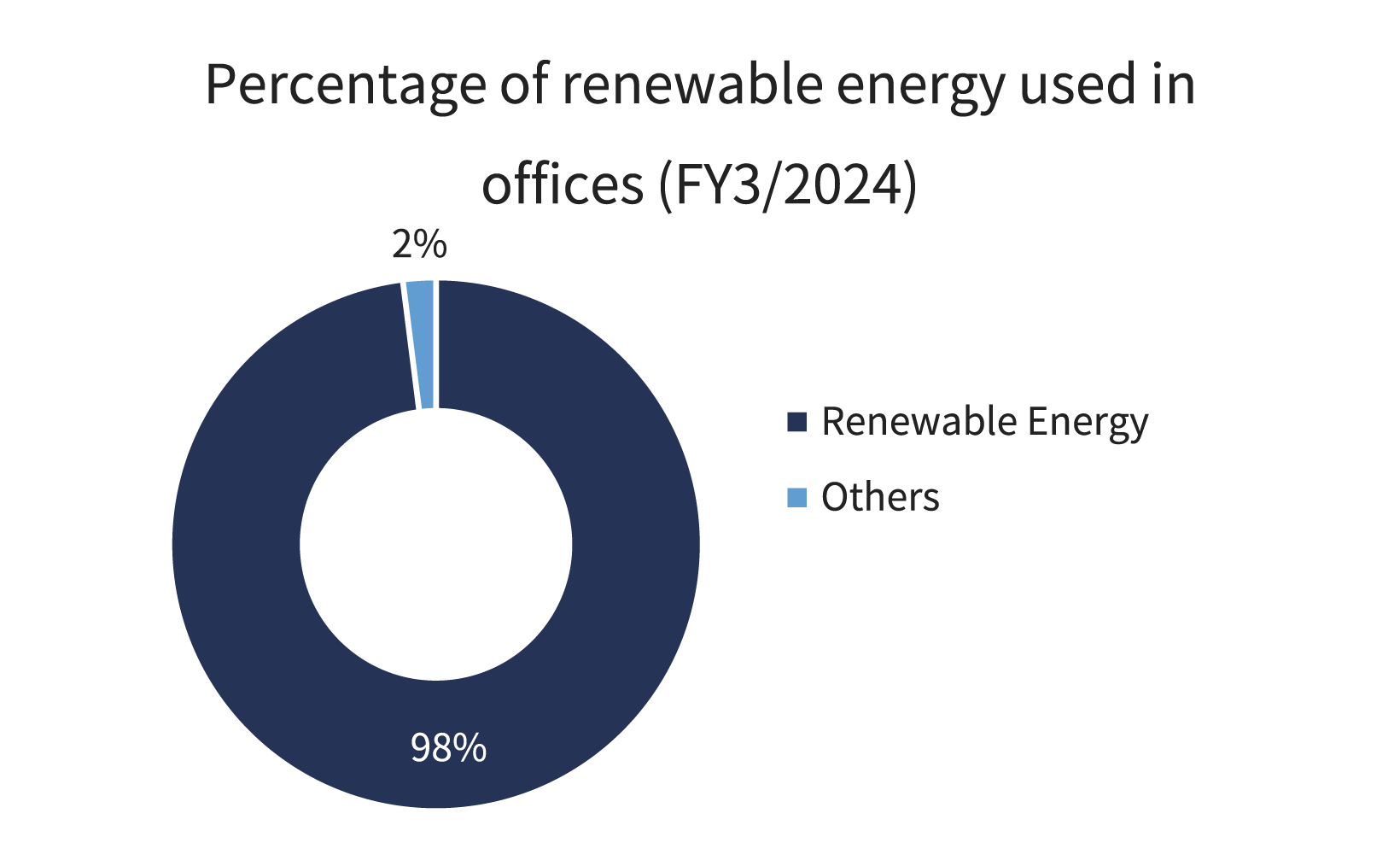

Simplex Group has its offices in Mori Building office buildings that take proactive and cutting-edge approaches to environmental issues. Approximately 92% (by square footage) of the offices we occupy use 100% electricity derived from renewable energy sources. By proactively selecting sustainable business environments, we are engaging in responsible energy management.

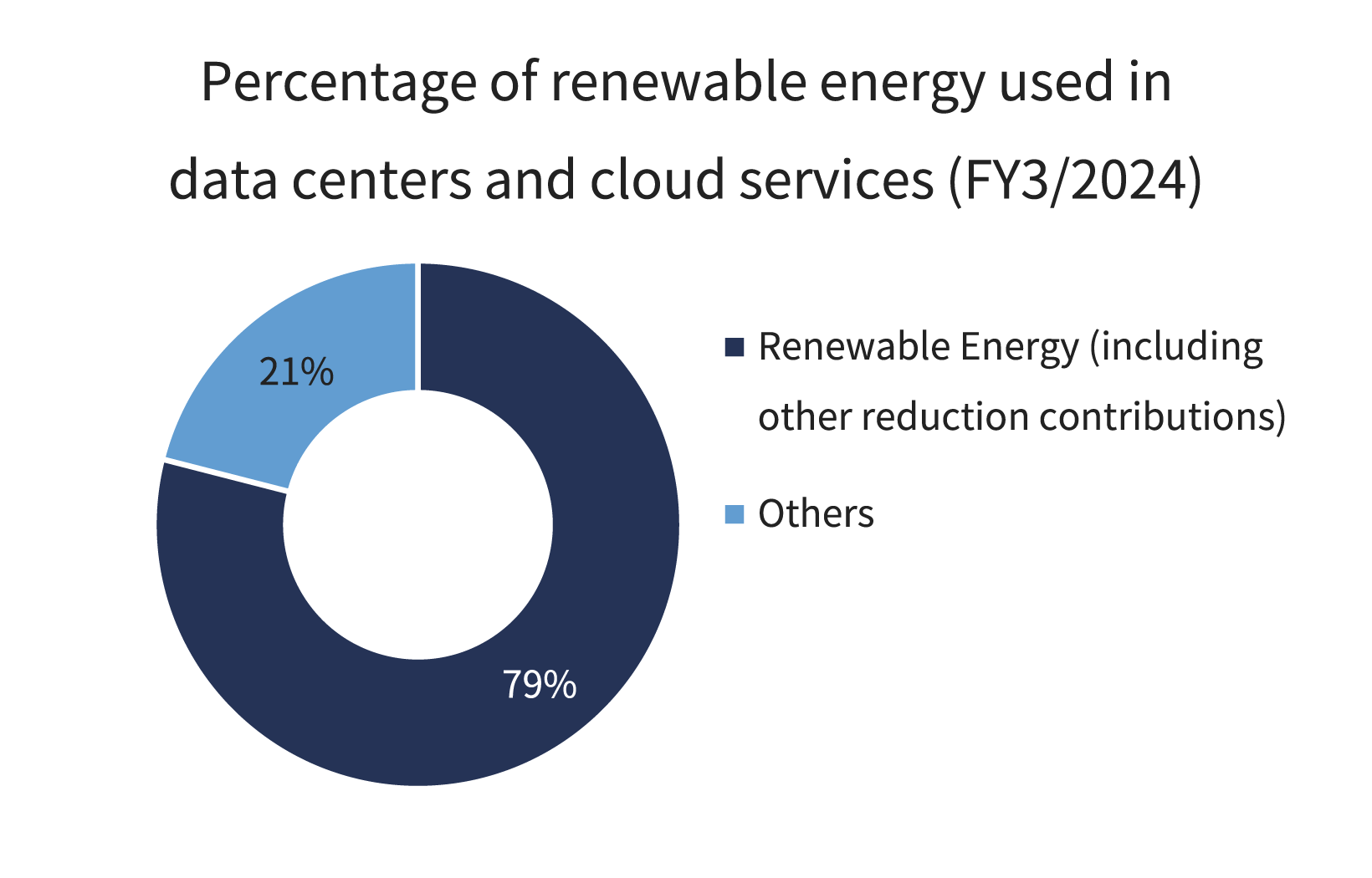

For our internal systems, we actively use cloud servers, which are energy-efficient and help to reduce the burden on the global environment. Even in our client systems, we have developed support services for companies that choose to make use of the most advanced cloud computing. Since 2020, we have also participated in the “FISC*1-compliant APN*2 Consortium” by Amazon Web Services (AWS), a leading cloud server provider, with the aim of facilitating FISC compliance and promoting the use of AWS by financial institutions.

Click here for more information on AWS―Environmentally Friendly Cloud and 100% Renewable Energy Initiatives.

FISC : The Center for Financial Industry Information Systems

APN : Amazon Partner Network

Biodiversity

Simplex Group is housed in the Azabudai Hills Mori JP Tower which is located in a 2.4ha green space, including the 6,000m² central square, and the Toranomon Hills Mori Tower, which features 6,000 m² of green space built on reclaimed land and has received the highest rank (AAA) of JHEP certification * in recognition of its biodiversity-conscious landscaping plan.

Click here for more information on biodiversity efforts at our business locations

(reference: Mori Building sustainability website).

Japan Habitat Evaluation and Certification Program (JHEP), certifies projects that contribute to biodiversity or avoid negative impacts on biodiversity. Certification is granted by the Ecosystem Conservation Society-Japan, with eligibility based on achieving a “nature value for the next 50 years” obtained by implementing a project that exceeds the “evaluation standard.”

Water Conservation

At the Azabudai Hills Mori JP Tower and the Toranomon Hills Mori Tower, where the Simplex Group occupies offices, we utilize relatively clean wastewater as recycled water for flushing toilets in offices and adopt water-saving fixtures with a high performance. Furthermore, we collect and filter rainwater from the entire site to sprinkle on exterior plantings.

Click here for more information on water conservation efforts at our business locations

(reference: Mori Building sustainability website).

BCP & Resilience

The Simplex Group is integrating a Business Continuity Plan (BCP) to ensure that the systems and services we provide are not susceptible to prolonged interruptions. We are dedicated to taking the measures necessary to safeguard our valuable information assets from disruptions and disasters, and to ensure the prompt resumption of business activities.