Environment Management

As a member of a society that operates in a global environment, we believe that addressing climate change and other environmental issues is vital. We recognize the need to reduce the environmental impact of our business activities and are proactively working to address environmental issues and collaborate with other companies that aim to realize a sustainable society. We voluntarily adhere to the TCFD, which has established a framework for international disclosure of information on climate change. In addition to disclosure and monitoring based on climate change risk, we also support biodiversity conservation efforts and promote the conservation and rational use of the world’s limited water resources.

Energy Management

In June 2021, the Ministry of Economy, Trade and Industry of Japan released the Green Growth Strategy for carbon neutrality by 2050. The Strategy recommends the promotion of next-generation power management to achieve zero energy in office buildings. It also states that data centers are to be carbon neutral by 2040. The government will support efforts to achieve zero emissions in data centers by improving the ratio of renewable energy use and energy-saving performance. Furthermore, the government will strive to concurrently realize a digital society and a green society by strengthening resilience through promoting decentralized location in regional cities and utilizing renewable energy to improve business continuity capacity in the event of a disaster.

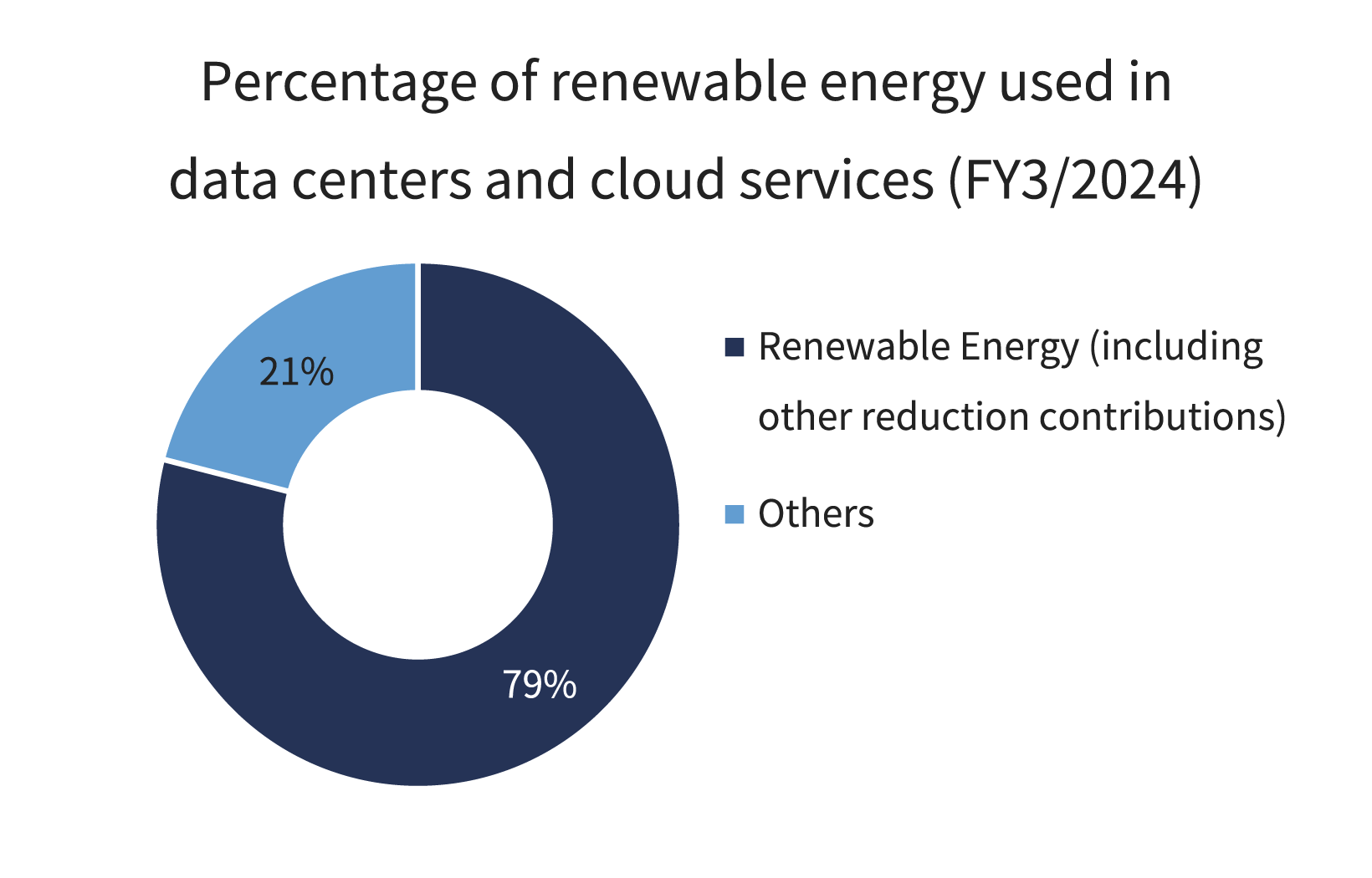

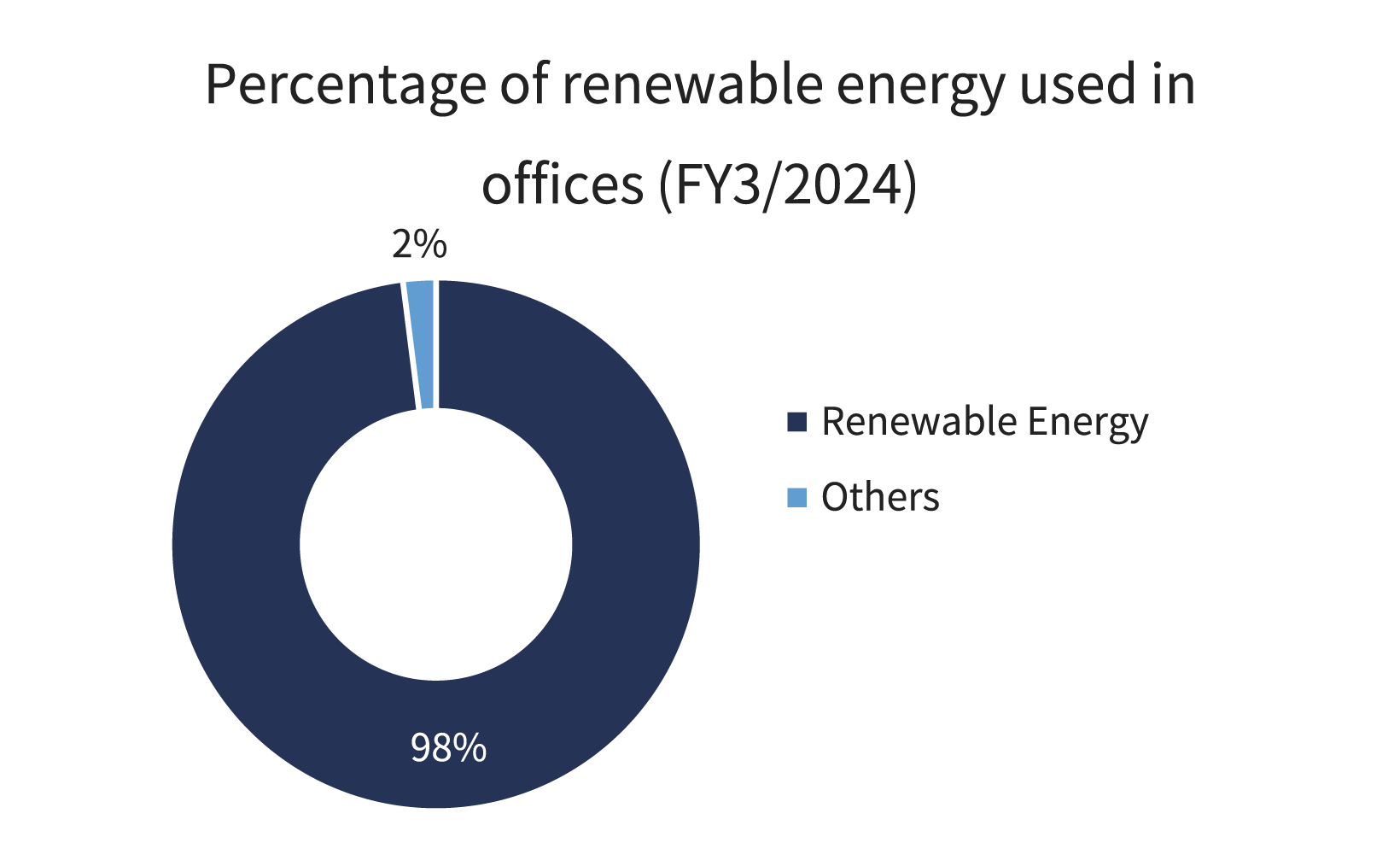

Given these developments, the Simplex Group locates its offices in office buildings operated by Mori Building Co., Ltd., which takes proactive and cutting-edge approaches to environmental issues. All of the offices we occupy use electricity derived from fully renewable energy sources. By proactively selecting sustainable business environments, we are engaging in responsible energy management.

For internal systems, we actively utilize cloud servers, which are energyefficient and help reduce the burden on the global environment. We are also developing cutting-edge cloud computing support services for our corporate clients.

Since 2020, we have been participating in FISC-compliant APN Consortium of Amazon Web Services (AWS) to promote the use of AWS by financial institutions and the facilitation of compliance with the FISC Security Guidelines*1.

FISC Security Guidelines are a set of guidelines and explanatory notes on security measures for computer systems for financial institutions, etc., established by the Financial Information Systems Center (FISC) as voluntary guidelines for financial institutions, etc. in Japan

Biodiversity

The Simplex Group is housed in the Azabudai Hills Mori JP Tower, which is located in a 2.4ha green space, including the 6,000m² central square, and the Toranomon Hills Mori Tower, which features 6,000m² of green space built on the open space and has received the highest rank (AAA) of JHEP certification*2 in recognition of its biodiversity-conscious landscaping plan *3.

JHEP stands for Japan Habitat Evaluation and Certification Program, which evaluates and certifies initiatives that contribute to the conservation and restoration of biodiversity . The program is developed and operated by the Ecosystem Conservation Society-Japan.

For more information on biodiversity initiatives at our business sites, please visit the Sustainability website of Mori Building Co., Ltd.

Water Conservation

At the Azabudai Hills Mori JP Tower and the Toranomon Hills Mori Tower, where the Simplex Group occupies offices, we utilize relatively clean wastewater as recycled water for flushing toilets in offices and adopt watersaving fixtures with a high performance. Furthermore, we collect and filter rainwater from the entire site to sprinkle on exterior plantings*4.

For more information on our efforts to conserve water resources, please visit the Sustainability website of Mori Building Co., Ltd.

BCP & Resilience

The Simplex Group is integrating a Business Continuity Plan (BCP) to ensure that the systems and services we provide are not susceptible to prolonged interruptions. We are dedicated to taking the measures necessary to safeguard our valuable information assets from disruptions and disasters, and to ensure the prompt resumption of business activities.

Response to TCFD Recommendations

Through our business activities, Simplex Group confronts the issues that must be dealt with to realize a sustainable society, aiming to achieve the kind of sustainable development that grows along with the global environment and society.

As part of these efforts, in June 2023, we agreed to the TCFD recommendations, which established the framework for international climate change disclosure, and declared our intention to join the TCFD Consortium.

Based on this recommendation and in recognition of climate change’s impacts on our business activities as a company, we are committed to promoting efforts to achieve a decarbonized society, and to improving our disclosure practices in line with the TCFD recommendations.

Governance

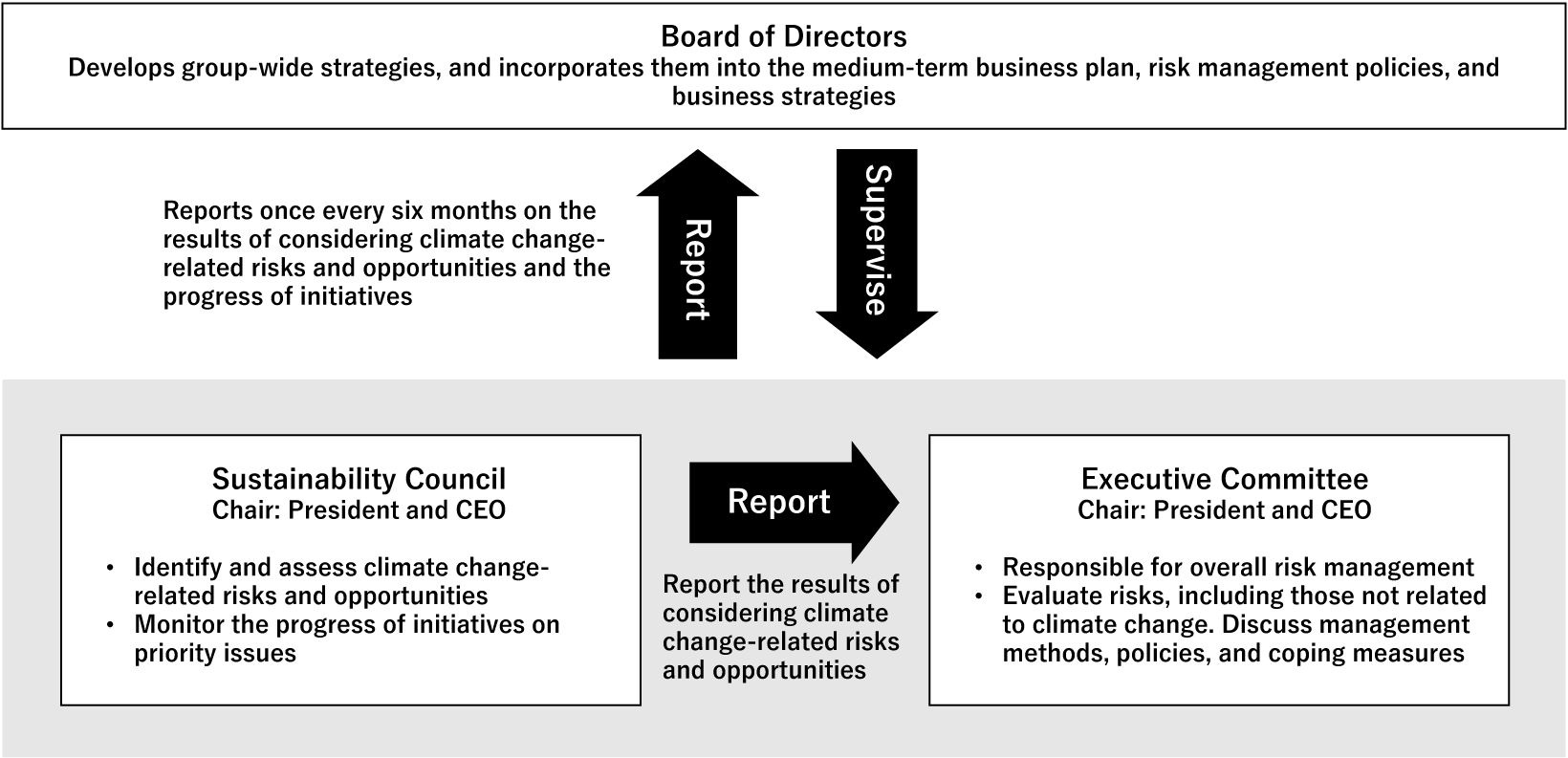

Under the supervision of Board of Directors, Simplex Holdings, Inc. (“the company”) carries out company-wide risk management at its Executive Committee meetings, which are chaired by the Representative Director, President and CEO (“CEO”) and comprise the CEO and Executive Directors. However, authority is delegated to the Sustainability Council for the identification and assessment of climate change-related risks and opportunities. The Sustainability Council consists of the CEO as well as the Executive Directors of the Company and its subsidiaries, and is chaired by the CEO. Assessments of climate change-related risks and opportunities discussed at Sustainability Council meetings, as well as the progress of related goals and initiatives, are reported to and debated by the Executive Committee as part of company-wide risk management. They are also reported to the Board of Directors on a semi-annual basis, enabling effective board oversight. Based on these reports, the Board of Directors develops group-wide strategies and incorporates them into the medium-term business plan, risk management policies, and business strategies

Risk Management

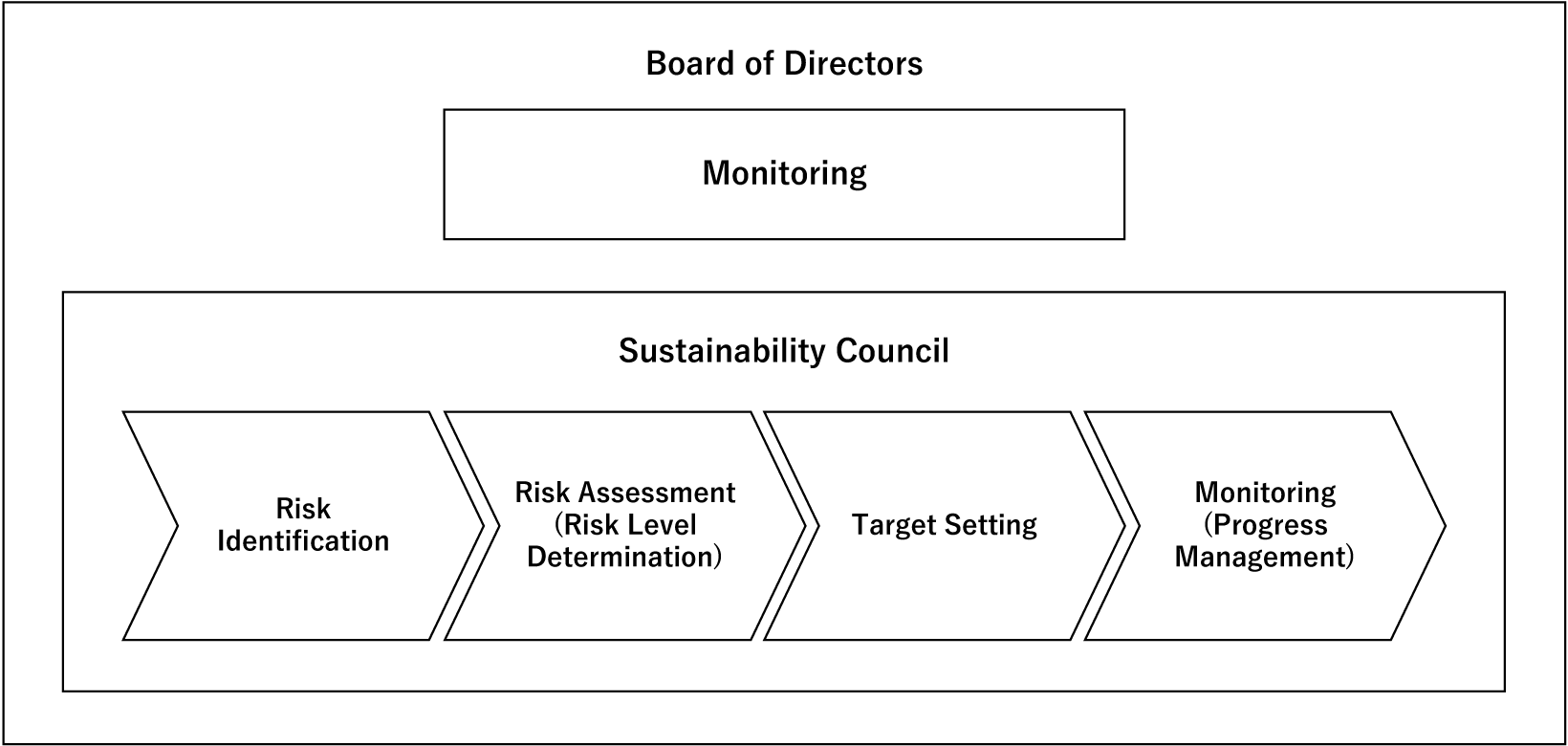

The company defines risk as any hazard that could result in economic loss, business interruption or suspension, or loss of credibility or brand image, and we have implemented a risk management system to mitigate and avoid risk. At Sustainability Council meetings, each member reports on climate change issues based on the environment surrounding the Group, and a wide range of climate change-related risks are identified. These identified risks are then evaluated on two axes: the likelihood of occurrence and impact on the Group in the event of an actual occurrence, and the risk level of each risk is determined. Significant risks are reported to the Executive Committee and the Board of Directors.

For risks related to climate change that are considered material, the Sustainability Council sets targets, manages progress, and reports to the Board on a semi-annual basis. This provides a mechanism for regular monitoring of risks and helps ensure that the progress of measures is assessed and the severity of the risk is reviewed.

Strategy

With regard to the impact of climate change on the Group’s business, we recognize that risk response (avoidance, reduction, transfer, and retention) and opportunity capitalization are critical management issues. As a result, we have broadly considered the short-, medium-, and long-term impacts of climate change and identified material risks and opportunities.

| Timeline | Period covered | Approach to Assumed Developments Along the Timeline |

|---|---|---|

| Short term | 0-3 years | Organize items that are already evident, such as current initiatives and areas where sales are increasing, as short-term issues. |

| Medium term |

3-10 years (including 2030) |

Organize items that are not occurring right now but have a very high likelihood of occurring by 2030, such as a carbon tax, as medium-term issues. |

| Long term |

10-30 years (including 2050) |

With a focus on the physical risks of disasters, organize items anticipated to have a significant impact after the 2030s as long-term issues. |

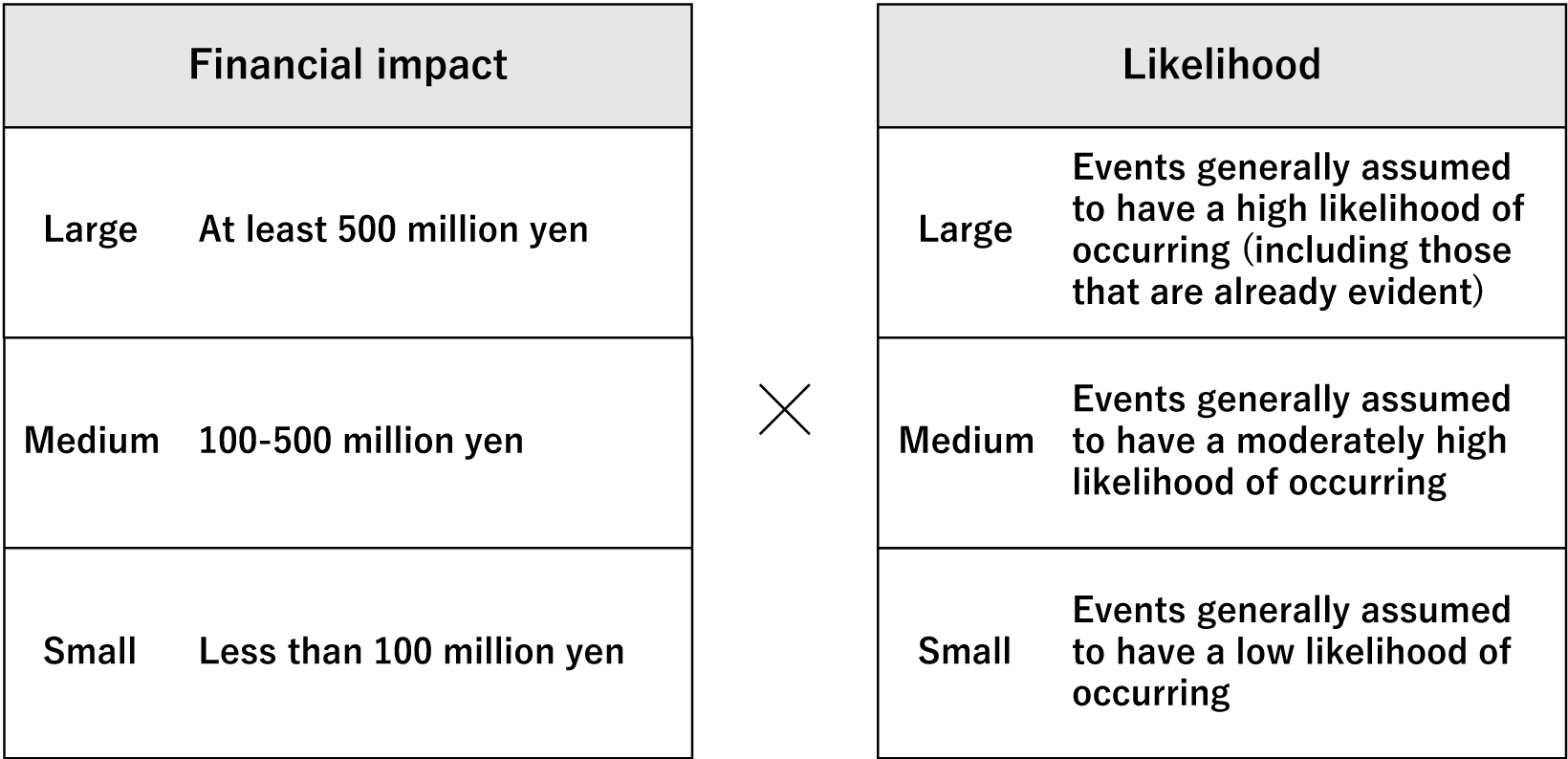

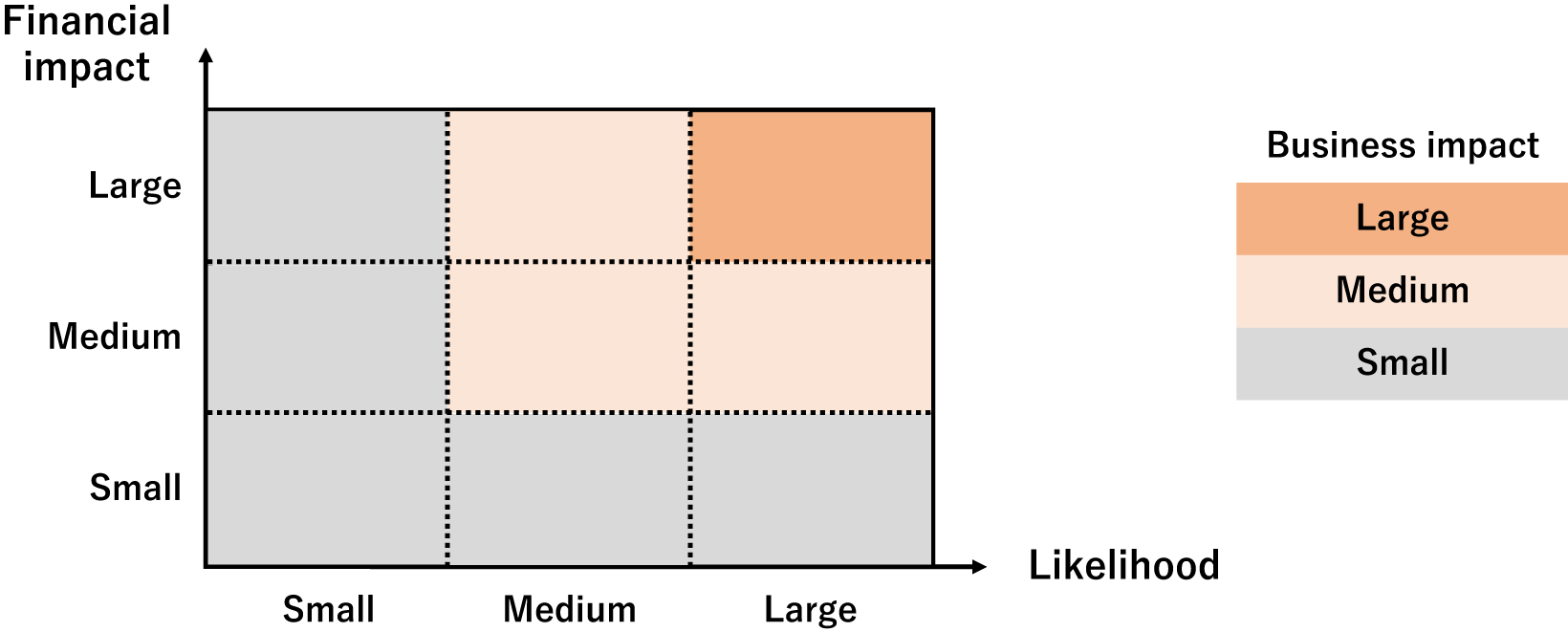

With respect to the impact of each risk and opportunity on our business, we conducted an analysis under two scenarios: a scenario where global temperatures rise by less than 2°C (“below 2°C scenario”), in which climate change policies and regulations are expected to progress; and a scenario where they rise by 4°C (“4°C Scenario”), in which disasters would become more severe and chronic risks caused by global warming are expected. From the analysis, we calculated the impact (impact score) on the business along the two axes of financial impact and likelihood of occurrence, as shown below.

Visualization of the Business Impact Calculation

Based on the above analysis, we identified the risks and opportunities that could impact our business activities due to climate change, as detailed in the table below. Note that, in considering each item, we referred to the IEA (International Energy Agency) WEO 2022 Net Zero by 2050, IEA WEO 2022 STEPS, IPCC RCP8.5 scenario, etc. Below is a summary of our perception of the business environment under each scenario as well as the impacts on business activities.

■ Below 2°C Scenario

In the “Below 2°C Scenario,” we recognize the formation of a business

environment

similar to below, in which countries advance climate change responses and regulations to reduce

temperature rises, and transition risks *1 emerge as society as a whole moves toward a

low-carbon society.

[Overall Image of Society]

Measures to address climate change are aggressively implemented, and

more

regulations and policies, such as a carbon tax, are imposed. Each company is forced to bear the costs

of

regulatory compliance and investments to reduce environmental impact. The transition to renewable

energy

and innovations in decarbonization technology progress, and demand for products and services that can

contribute to a low-carbon society increases as customer awareness changes.

[Changes in the Group’s Business Environment]

In order to make business operations more efficient,

we

can expect companies to put more effort into promoting DX, and sales opportunities to increase due to

the

growing need for system integration, etc.

We can also expect business opportunities to emerge in areas such as climate change-related system

integration and consulting.

Of the various climate change risks, this refers to those that arise as a result of new policies and technological advances in the process of transitioning to a low-carbon society.

■ 4°C Scenario

In the “4°C Scenario,” we recognize the formation of a business environment similar

to

below, in which the failure to aggressively address climate change results in severe impacts from

physical

risks *2, including frequent large-scale disasters and diminished business continuity.

[Overall Image of Society]

Although some progress is made in climate change regulations and

policies,

especially in developed countries, their effectiveness is low, resulting in insufficient measures

being

taken and environmental regulations having little influence on business activities. Meanwhile, we can

expect that temperatures will rise unabated and that disasters will occur more frequently and with

greater

severity.

[Changes in the Group’s Business Environment]

Not only can we expect disasters to affect our

offices,

but we can also expect risks such as data center outages, which are core to our Group’s operations.

However, we can expect ICT to play an even greater role as the frequency of disasters increases and

the

importance of resilience-related solutions such as climate adaptation, disaster prevention, and

mitigation

rises at the same time.

Of the various climate change risks, this refers to those that cause physical damage as a result of increasingly severe natural disasters, more heat waves, rising sea levels, etc.

(Table) Climate Change Impacts on the Group

| Risks and Opportunities | Type | Impact | Major Impact on the Group | Timeline | Buisiness Impact | Possible Measure | |

|---|---|---|---|---|---|---|---|

| below 2℃ | 4℃ | ||||||

| Transition Risks | Policy and Legal Risk | Carbon Pricing Mechanism |

|

Medium term | Low | - |

|

| Market Risk | Changing Customer Behavior |

|

Medium term | Medium | - |

|

|

| Reputational Risk | Sector condemnation |

|

Medium term | Low | - |

|

|

| More stakeholder concerns or negative stakeholder feedback |

|

Medium term | Low | - |

|

||

| Physical Risks | Increased frequency of typhoons, floods, and other extreme weather events that cause extensive damage |

|

Long term | Low | Medium |

|

|

| Opportunities | Products and Services | Financing for the development and/or expansion of low-emission services |

|

Short term | Low | - |

|

| Development of solutions for climate adaptation, resilience, and risk |

|

Medium to long term | Medium | Medium |

|

||

|

Medium term | Medium | - | ||||

| Markets | Taking proactive action on climate change |

|

Medium term | Medium | - |

|

|

| Resilience | Improvement of employee working conditions, etc. |

|

Short term | Low | Low |

|

|

Metrics and Targets

With regard to the Group’s greenhouse gas emissions as of the end of the fiscal year ending March 2025, we have calculated Scope 1 and Scope 2 emissions as below based on the government’s “General Guidelines on Supply Chain GHG Emission Accounting” (March 2025, MOE & METI).

The actual results for Scopes 1 and 2 are shown below. We have set reduction targets for the target fiscal year and are actively working on reduction activities such as conversion to renewable energy sources.

| Items | Greenhouse gas emissions (t-CO₂) | ||||

|---|---|---|---|---|---|

| Actual values (FY03/2024) | Actual values (FY03/2025) | Target value (target fiscal year) | |||

| Scope1 Direct Emissions*1 |

0 | 0 | 0 (FY03/2026) |

||

| Scope2 Energy-Derived Indirect Emissions*2 |

10.3 | 0 | 0 (FY03/2026) |

||

Direct emissions from the company’s use of fuels and industrial processes are excluded from the calculation as they are negligible.

Energy-Derived Indirect Emissions are indirect emissions associated with the use of electricity and heat purchased by the company. We purchase electricity, etc., used at our business locations at (1) Toranomon Hills Mori Tower, (2) Azabudai Hills Mori JP Tower, and (3) Atago Green Hills MORI Tower from the Mori Building. Since January 2023, they have been purchasing renewable energy based on the terms of their electricity contract in phases.

Additionally, the table below shows actual results for Scope 3 and their breakdown by category.

| Items | Greenhouse gas emissions (t-CO₂) | ||

|---|---|---|---|

| Actual valuesbr (FY03/2024) |

Actual valuesbr (FY03/2025) |

||

| Scope3 Other Indirect Emissions |

6,880.0 | 8,347.9 | |

| Category1 Purchased goods and services |

3,376.1 | 4,219.3 | |

| Category2 Capital goods |

1,980.0 | 2,012.2 | |

| Category3 Fuel and energy related activities not included in Scope 1 or 2 |

77.2 | 89.5 | |

| Category4 Transportation and delivery (upstream) |

N/A*3 | N/A*3 | |

| Category5 Waste generated in operations |

16.4 | 26.3 | |

| Category6 Business travel |

418.2 | 644.7 | |

| Category7 Employee commuting |

1,012.1 | 1,356.0 | |

| Category8 Leased assets (upstream) |

N/A*4 | N/A*4 | |

| Category9 Transportation and delivery (downstream) |

N/A*3 | N/A*3 | |

| Category10 Processing of sold products |

N/A*3 | N/A*3 | |

| Category11 Use of sold products |

N/A*3 | N/A*3 | |

| Category12 End-of-life treatment of sold products |

N/A*3 | N/A*3 | |

| Category13 Leased assets (downstream) |

N/A*3 | N/A*3 | |

| Category14 Franchises |

N/A*3 | N/A*3 | |

| Category15 Investments |

N/A*3 | N/A*3 | |

Categories for which there is no target to be calculated or which are of low importance in the Group’s business are not included in the scope of disclosure.

Assuming that leased assets used in offices use electricity, these are included in the Scope 2 calculations.