Basic Policy

With the goal of bringing “Innovation from Japan to the world,” all of us are united in our pursuit of “Creating high value-added services” that contribute to the business success of our clients. We are committed to building fair and sound relationships with various stakeholders and to establishing frameworks that enhance both the transparency and efficiency of our management, with the aim of achieving sustainable growth and increasing corporate value.

Corporate Governance Efforts

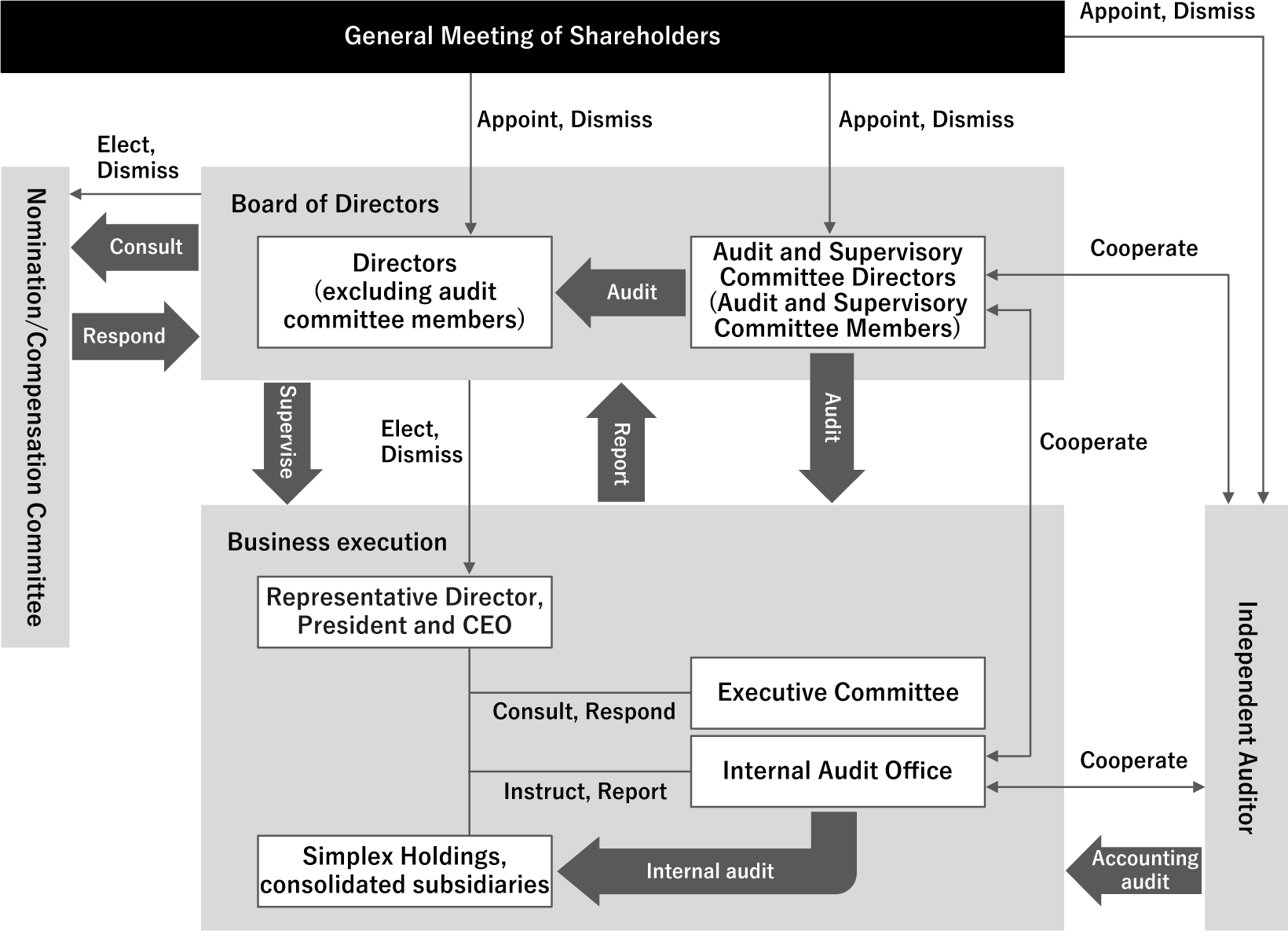

Corporate Governance Structure

We have adopted an audit and supervisory committee system to further enhance corporate governance by strengthening the supervisory function of the Board of Directors, as well as to improve management efficiency and enable prompt decision-making. Under the Companies Act of Japan, the Audit and Supervisory Committee is required to be composed of at least three directors and a majority of whom must be outside directors, and all six members of the Audit and Supervisory Committee are outside directors.

Independent Audit and Supervisory Committee members have voting rights at Board of Directors meetings, and the Audit and Supervisory Committee further enhances the management oversight function by proactively utilizing the internal control system to conduct audits. Furthermore, the Audit and Supervisory Committee strengthens and enhances the management oversight function by having an environment that allows the Committee members to voluntarily attend various meetings, including Executive Committee meetings, and by conducting inspection of the minutes of such meetings.

Board of Directors

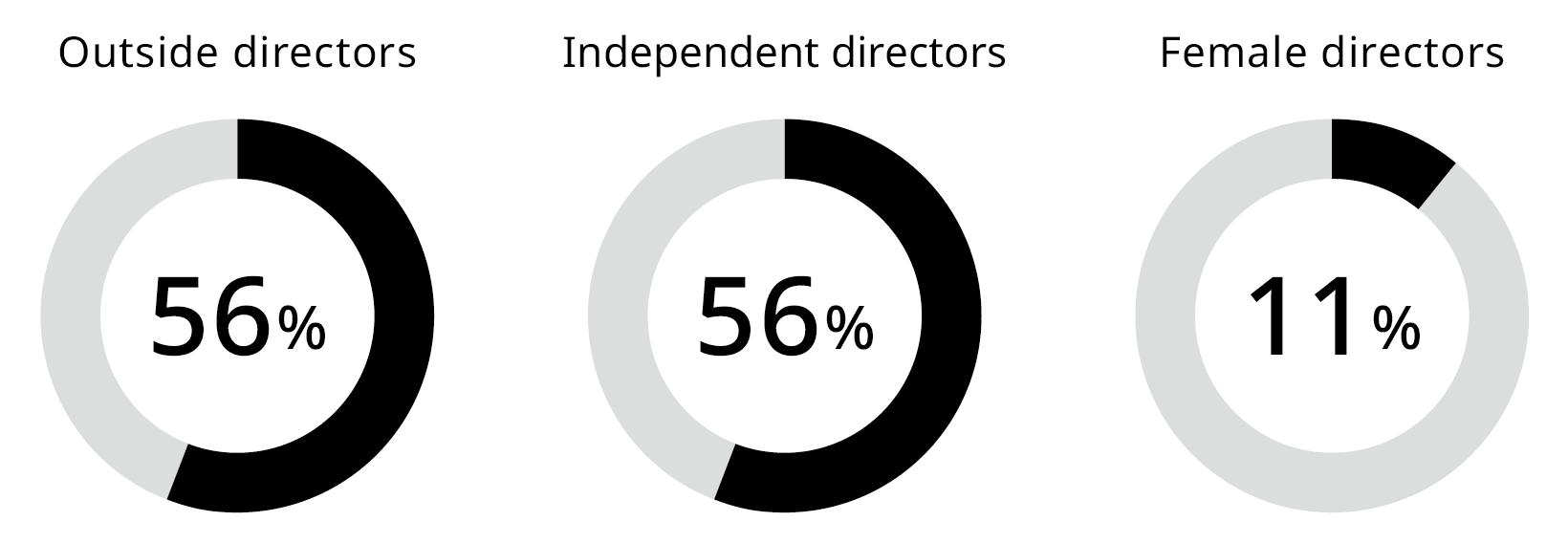

The Board of Directors consists of the Representative Director, President and CEO, three executive directors, and six outside directors (ten members in total). Board members are selected so that the majority are outside directors. We aim to improve management transparency by revitalizing the Board as a decision-making body, developing a system to prevent fraud, and strengthening the management oversight function over the management team.

At the Board meetings, executive directors make regular reports on the status of their execution of duties and business performance. All directors engage in lively discussions on priority issues in response to changes in the business environment. Specifically, directors share issues related to the enhancement of human capital, discuss how to deploy talent, and share and discuss the latest technology and security issues. In each of these, the executive directors and outside directors discuss and consider matters that contribute to the Simplex Group’s medium- and long-term development from their own perspectives, rather than focusing solely on short-term performance trends.

Board Composition (as of June 30, 2025)

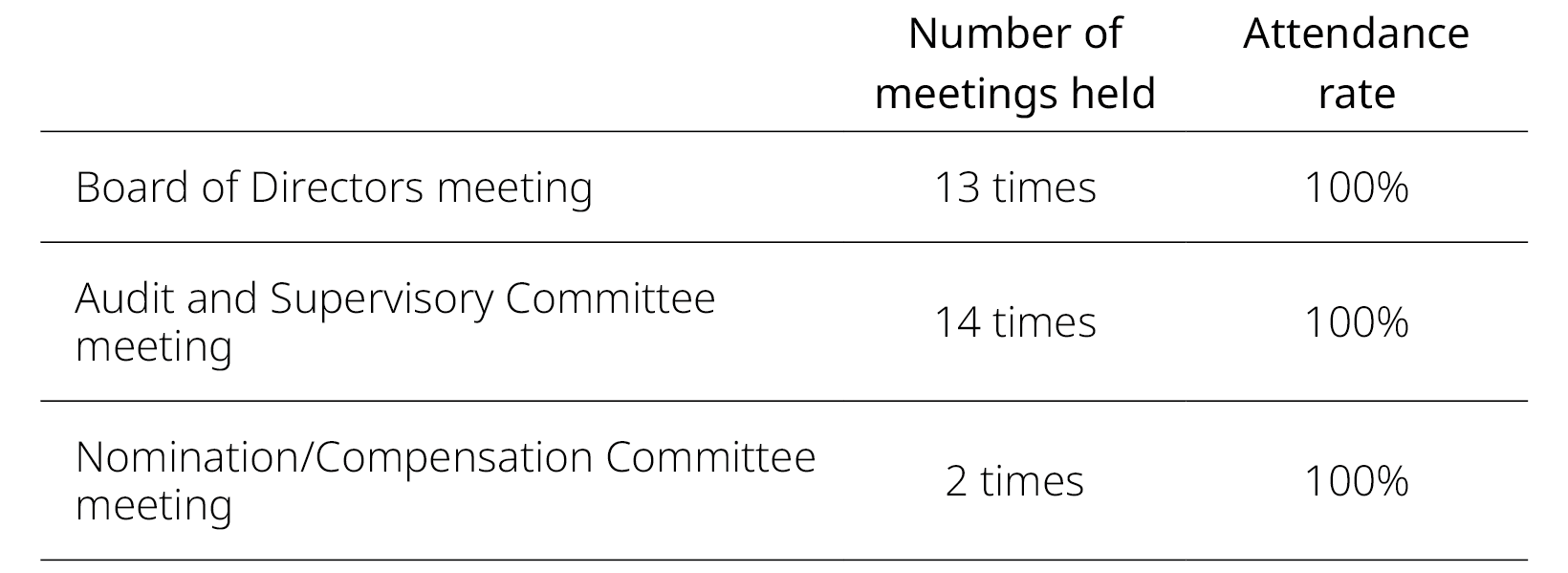

Number of meetings held and attendance rate

Nomination/Compensation Committee

In order to enhance the transparency and objectivity of the deliberation process in the election and dismissal of directors and the compensation system, a voluntary Nomination/Compensation Committee has been established as an advisory body to the Board of Directors. Matters on the election and dismissal of directors and compensation are first heard by the Nomination/Compensation Committee, and then determined at the Board meeting based on the content of the Committee’s report. The Nomination/Compensation Committee consists of at least three members elected from among the directors of the Company, with the majority of committee members being outside directors.

Executive Committee

The Executive Committee consists of the representative director, president and CEO and three executive directors. As an advisory body to a representative director, president and CEO, the Executive Committee meets at least twice a month in principle so that they can deliberate and assess important matters on the execution of the Company’s business. By discussing a wide range of management issues, large and small, we have developed a system that can respond to the rapidly changing IT industry and flexibly implement corporate strategies.

Analysis and evaluation of the Board effectiveness

During the fiscal year ended March 31, 2023, we analyzed and evaluated the Board effectiveness as a whole based on each director’s self-assessment. As a result, the Board was evaluated as having effective governance and efficient operation, thereby ensuring effectiveness, given that the majority of the Board members consists of outside directors with diverse experience and knowledge. At the same time, there were requests for the appointment of more diverse talent, considering gender diversity, and for more information sharing on medium- to long-term corporate strategies.

Policy and Process for Determining Director Compensation

Compensation for directors (excluding Audit and Supervisory Committee members) is initially discussed by the Nomination/Compensation Committee, and then determined by the Board of Directors based on the content of the Committee’s report. This is subject to the maximum amount of compensation determined by a resolution of the General Meeting of Shareholders. Compensation for directors serving as Audit and Supervisory Committee members is decided through discussions among all Audit and Supervisory Committee members.

The policy for determining the individual compensation for directors (excluding Audit and Supervisory Committee members) is resolved by the Board of Directors as per the proposal prepared in advance by the Nomination/Compensation Committee. The specific decision-making policy is as follows.

- All individual compensation of directors (excluding Audit and Supervisory Committee members) shall be paid in the form of monthly cash compensation and bonuses that are not linked to performance.

- The Nomination/Compensation Committee shall determine the proposed amount of monthly cash compensation based on comprehensive consideration of factors such as position, responsibilities, years in office, individual contributions, and the Company’s business performance.

- The Nomination/Compensation Committee shall make a proposal on bonuses as cash compensation when it deems it necessary to provide appropriate incentives after comprehensively considering the Company’s business performance and other factors.

- Bonuses as cash compensation shall be paid within three months after the end of the fiscal year.

The Board of Directors has confirmed that the method of determining the details of the compensation, and the details of the individual compensation for directors (excluding Audit and Supervisory Committee members) for the fiscal year ended March 31, 2025 are consistent with the decision policy approved by the Board of Directors and therefore, determined that the compensation is in line with the decision policy.

Director Candidate Selection and Dismissal Policy and Process

With respect to the election of directors, the Company selects candidates who are of excellent character and insight, and who possess a wealth of experience and expertise appropriate for serving as directors of the Company. In addition, for the election and dismissal of directors, the Nomination/Compensation Committee, whose majority of members are outside directors, has been established as an advisory body to the Board of Directors to make initial proposals. In addition, in the notice of convocation of the General Meeting of Shareholders, the reasons for electing each candidate as a director are explicitly stated.

Skills Required of Director Candidates

We have identified the following six skills that the Board of Directors should possess, and we appoint directors with consideration for the diversity and balance of these skills.

| Corporate management | Experience and expertise as a corporate manager, including experience as a director |

|---|---|

| IT / Technology | Knowledge and insights on IT, DX or other technologies, and work experience and expertise in system development and operations |

| Finance / Accounting | Certified Public Accountant, Certified Tax Accountant, work experience in an accounting or finance department, or other experience or expertise in the finance or accounting field |

| Internationality | Corporate management or work experience in global companies, or experience and expertise in overseas business development and the like |

| Personnel affairs / Human resources development | Work experience in a personnel department, and other experience and expertise in the human resources and organizational fields such as personnel training, and design and development of internal systems |

| Legal / Compliance | Experience as a lawyer or work experience in a legal or compliance department, as well as experience/expertise in risk management or corporate governance |

Other Initiatives

Internal Control

Based on our Basic Policy on Internal Control Systems, we strive to ensure appropriateness and efficiency in execution of duties by directors based on thorough compliance with laws and regulations and understanding of social ethics. Specifically, the Audit and Supervisory Committee audits whether the execution of duties by directors complies with laws and regulations, and ensures its effectiveness by utilizing the internal control systems. In addition, the Internal Audit Office, which reports directly to the representative director, president and CEO, evaluates the operation of internal controls.

Cross-shareholdings

With respect to cross-shareholdings, we hold the appropriate number of shares in another company based on the results of due diligence only when it is deemed reasonable to hold the shares, such as when it contributes to the enhancement of the Company’s corporate value over the medium to long term through the maintenance and strengthening of business relationships as well as the maintenance and development of business partnerships. We exercise our voting rights for all cross-shareholdings. In exercising such rights, we make decisions about whether to approve or reject each proposal after careful consideration based on criteria such as whether it will lead to enhancing the corporate value of both Simplex Holdings and the investee company or whether it will damage the corporate value of both companies.